Course Highlights and Why GST Training in Kanchipuram at FITA Academy?

Upcoming Batches

- 17-04-2025

- Weekdays

- Thursday (Monday - Friday)

- 19-04-2025

- Weekend

- Saturday (Saturday - Sunday)

- 21-04-2025

- Weekdays

- Monday (Monday - Friday)

- 26-04-2025

- Weekend

- Saturday (Saturday - Sunday)

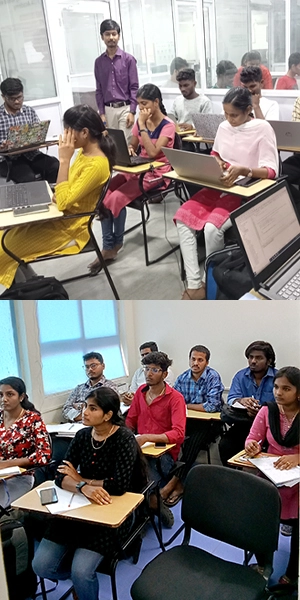

Classroom Training

- Get trained by Industry Experts via Classroom Training at any of the FITA branches near you

- Why Wait? Jump Start your Career by taking the GST Classroom Training in Kanchipuram!

Instructor-Led Live Online Training

- Take-up Instructor-led Live Online Training. Get the Recorded Videos of each session.

- Travelling is a Constraint? Jump Start your Career by taking the GST Course Online!

GST Course Objectives

- Learn the GST concepts, structures, and advantages in the Indian economy.

- Get to know how to identify different types supplies like intra-state, inter-state, and composite and how to apply them under GST.

- Learn to classify GST under slabs and calculate tax liability accurately.

- Know how to register for GST, return filing, and adhere to standards.

- Understand the concept of ITC and its utilisation for efficient tax management.

- Configure GST settings in Tally for company, ledger, and inventory levels.

- Create, modify, and print GST invoices for purchases and sales transactions.

- Record GST transactions (purchase/sales) with unregistered dealers and utilize reverse charge mechanism.

GST Course Trainer Profile

- Trainers of GST Course in Kanchipuram possess over a decade of professional experience of taxation, auditing, and accounting field.

- Our trainers are real-time professionals working in various sectors, providing industry-relevant skills.

- Instructors provide hands-on training on GST structure, GST compliance, and computation.

- GST trainers at FITA Academy provide in-depth training on the taxation process.

- Trainers provide hands-on experience by guiding the students working on real-time projects.

- They regularly conduct assessments to monitor the progress of each student.

- Trainers provide personalised attention to each student, clearing their doubts after every session.

Learn at FITA Academy & Get Your

Dream IT Job in 60 Days

like these Successful Students!

Student Success Story of GST Training in Kanchipuram

Kirthana, from Kanchipuram, after completing a B.Com (C.A) degree, wanted to learn particularly about GST. She had doubts about whether anyone would provide the best course for GST. So, she discussed it with her friends and looked for the right GST Coaching Classes in Kanchipuram. Then, she came to know that FITA Academy has been offering an extensive GST course and also with placement training.

She contacted FITA Academy and enquired about the course details. Our coordinators explained the features and benefits of the course. Satisfied, she decided to enroll in the course. Then, she opted for weekday class options. She attended all the classes regularly. She scored well on all the assessments. Under our trainer’s guidance, she completed real-time capstone projects. With all the skills acquired, she made her profile stand out during interviews and started practising as a GST Consultant on her own.

Features of GST Training in Kanchipuram at FITA Academy

Real-Time Experts as Trainers

At FITA Academy, you will learn from industry experts eager to share their knowledge with learners. You will also get personally mentored by the Experts.

LIVE Project

Get the opportunity to work on real-time projects that will provide you with deep experience. Showcase your project experience and increase your chances of getting hired!

Certification

FITA Academy offers certification. Also, get ready to clear global certifications. 72% of FITA Academy students appear for global certifications and 100% of them clear it.

Affordable Fees

At FITA Academy, the course fee is not only affordable, but you can also pay it in installments. Quality training at an affordable price is our motto.

Flexibility

At FITA Academy, you get the ultimate flexibility. Classroom or online training? Early morning or late evening? Weekday or weekend? Regular Pace or Fast Track? - Choose whatever suits you best.

Placement Support

Tied-up & signed MOUs with over 3000+ small & medium-sized companies to support you with opportunities to kick-start & advance your career.

Why Learn GST Training in Kanchipuram at FITA Academy?

Live Capstone Projects

Real time Industry Experts as Trainers

Placement Support till you get your Dream Job offer!

Free Interview Clearing Workshops

Free Resume Preparation & Aptitude Workshops

GST Certification Training in Kanchipuram

Getting certified in a GST course serves as proof that a student has acquired an understanding of GST filing and taxation principles. Including this certification on your resume can set you apart in job interviews. FITA Academy offers the GST Certification Course in Kanchipuram with the goal of providing top-notch training to help you secure paying employment opportunities. The GST course at FITA Academy is. Taught by professionals from the industry, ensuring that students acquire skills in the field. There are advantages to be gained from enrolling in our certification program.

Have Queries? Talk to our Career Counselor for more Guidance on picking the

right Career for you!

Placement Session & Job Opportunities after completing GST Training in Kanchipuram

Begin a taxing career through the GST Course in Kanchipuram offered by FITA Academy. It prepares you with the knowledge and skills needed to perform extremely well in the progressively expanding area of Goods and Services Tax (GST). However, our aim in preparing you for the future does not end in the formal learning environment of a classroom. To this, we provide you with placement services to ensure you secure a job after the completion of the course.

”After the completion of GST course, we offer 100% placement support.”

We have more than 3000 industry tie-ups, most of them are all in search of dedicated and competent GST professionals. We will help you build a strong resume with newly acquired GST skills. We also conduct mock interview sessions so that you can polish on the way you communicate and present yourself for that important interview. This is a good chance that should be seized soon! Get GST Training in Kanchipuram from FITA Academy.

The scope is quite high in this field. An entry-level candidate in GST can expect to get anywhere between Rs. 2 Lakhs to Rs. 5 Lakhs per annum, while a GST expert can expect anywhere between Rs. 15 Lakhs to Rs. 46 Lakhs per annum.

Gaining a GST Course in Kanchipuram with FITA Academy will lead you to new and interesting professional opportunities in the accounting and taxation sectors. Here are some of the most sought-after positions:

GST Practitioner

A GST practitioner involves taxation, especially on GST related issues for various companies. According to the need in GST, offers consultancy services in GST registration, filing of GST returns, maintenance of records and assists in complicated GST matters. May also appear for clients before the tax authorities. The desirable skills include being well acquainted with the GST laws and regulations, accounting standards, communication skills and interpersonal skills. It frequently needs the approval of a professional body.

Tax Consultant

A Tax consultant provides information on taxes other than GST such as income tax, corporate tax, and other indirect taxes. Also involves examination of tax effects in operations and strategies, use in tax advice, and reduction of taxes. May represent clients in a situation where the taxation authority is assessing or auditing the company. Specialization in different tax legislations, analysis and critical thinking, good interpersonal communication and client relation skills.

GST Auditor

They are responsible for scrutinising the businesses to check whether they are observing the set laws on GST or not. Examines the company’s records, checks the accuracy of GST calculations and returns filed, notes the differences, if any and suggests adjustments. May decide not to conform to any standard and may report such compliance to the authorities. Proficiency in the laws governing GST and auditing skills, the ability to analyse a problem critically as well as the ability to research the subject, negligence.

GST Compliance Manager

This role ensures that an organisation is implementing the Goods and Services Tax appropriately. Oversees the GST registration process and is responsible for the timely submission of returns, liaises with the tax authorities and oversees the organisational GST compliance, including the internal control mechanisms of the organisation’s GST records. Good knowledge of GST laws and norms, accounting knowledge and tax compliance, well organised and good communication skills.

Taxation Research Analyst

This role evaluates different difficult problems connected to GST for large organizations. Regularly searches for updates and changes in GST and offers views on the changes that have occurred with GST on business transactions and ways to minimize GST. Good problem solving and research skills, extensive knowledge about the GST and taxations, good understanding of structures and systems of business entities.

These are just some examples, and the names of the positions and the actual work that one has to do may also differ from company to company and within some definite branches of the economy. The end positions mentioned above can be acquired after taking a GST course that will enable one to acquire all the above skills. If you are in Kanchipuram and searching for the Top GST Coaching Center in Kanchipuram then join GST classes in FITA Academy in Kanchipuram.

Success Story of GST Training in Kanchipuram

Surendar

I was preparing for CA exams and I want to specialise in GST. I looked for many resources to learn about GST. I did not know where to start and how to start. Then my senior told me about FITA Academy conducting a GST course. Immediately, I joined the course and the skills gained were very helpful during interviews. Thank you!

Shakshi

The GST course at FITA Academy covers all the essentials needed to start a career. The trainers were very interactive. They also provided hands-on training with real-time projects integrated to the course. I recommend my friends to join FITA Academy.

Narayanan

GST training at FITA Academy was excellent. The trainers were very friendly. The cleared all the doubts in the session itself. The course is really worthy. Thank you!!!

Our Students Work at

Frequently Asked Question (FAQ) about GST Training in Kanchipuram

- Expertly designed course covering all the crucial concepts

- Trainers are real-time professionals possessing more than a decade of experience

- Extensive course at an affordable cost

- Provides Interview Tips and Corporate training

- Certification and placement support upon course completion

- Flexibly scheduled courses to fit your busy schedule

- Certainly! Upon completing the course, our placement cell supports you with mock interviews, group discussions, GST Interview Questions and Answers, and more.

- FITA Academy has tied up with over 3000 companies, ranging from small to large. So, there are plenty of job opportunities waiting for you.

- Our trainers are industry experts and boast more than a decade of experience in Auditing, Taxation and Accounting.

- These trainers are real-time professionals so students can gain industry-relevant skills from our trainers.

- We offer most individual attention to the students. So, each class size is optimised for 5 - 6 participants per batch.

- The batch size has been optimised to clear the doubts of the students in complicated topics genuinely with tutors.

General Q & A about GST Training in Kanchipuram

How many months is the GST course?

Can I do a GST course online?

Can I get a job after the GST course?

Is the GST course useful?

How many types of GST are there?

India has four types of GST:

- Integrated Goods and Services Tax (IGST)

- State Goods and Services Tax (SGST)

- Central Goods and Services Tax (CGST)

- Union Territory Goods and Services Tax (UTGST)

How to calculate GST?

What is the salary after a GST course?

What is the basic salary of GST?

Is there any course for GST?

What is the qualification for a GST job?